NewTack合资企业

- Advised emerging companies in the AI/ML space on fundraising initiatives and go-to-market strategies.

- Evaluated exit options for the company and evaluated IP for sale to a third party and managed wind down (employee termination) in conjunction with an independent director.

- Developed a SaaS reporting infrastructure and board reporting tools.

- Acted as a fractional CFO for a number of emerging technology companies, 包括NetSuite实现和策略开发.

- Raised multiple financing rounds (Seed and Series A) and term loan and venture debt facilities with Comerica and SVB.

重点领域:企业发展&战略,M&A(卖方),M&A(买方),M&A建模,M&A估值(DCF), NetSuite, Salesforce, 收入的策略, 收入模型, 早期的资金, 融资策略, Fintech顾问, 临时首席财务官

马林分析咨询

- 曾在一家营销技术公司工作, 包括创建商业和财务模式, 处理与潜在投资者的谈判, 建立进入市场的策略(例如.g., constructed a SaaS pricing model, customer contract documentation, and more).

- Advised the CEO and majority shareholders of a risk analytics software company on strategic options, including initiating merger discussions and completing a detailed financial and strategic analysis with a company that had complementary technology.

- Developed a business planning program and initiated fundraising discussions between an innovative B2B trade credit solution startup and investors.

- Created an alliance program for a lending software solution to leverage solutions into new partner distribution channels.

- Advised a startup insurance pricing optimization company on various funding and strategic alternatives—resulting in its sale to an industry participant.

- Undertook an analysis of emerging market participants in the marketing technology field for a leading financial services technology company interested in assessing a roll-up acquisition program.

- Acted as interim CFO and strategy advisor to technology companies. 实施ERP系统(完整), NetSuite, 和销售团队), 已开发的SaaS报告基础设施, 并为销售团队制定了薪酬计划. 还创建了董事会报告模板.

- Focused on advising growing companies in the predictive analytics and AI/ML space in the fintech and martech sectors developing tactics to productize technology and generate revenue.

Focus areas: 风险资本, Marketing 技术 (MarTech), 筹款, 财务规划 & 分析(FP&A), 数据分析, 技术, 创业公司, 营销计划, 金融建模, SaaS, 业务规划

红色视觉系统

- Completed two Series-2 financing rounds with venture investors and a term loan and revolver banking facilities with the bank.

- Implemented new ERP systems for accounting (Intacct), HR (ADP) and CRM (Salesforce).

- 开发和实现新的FP&A和董事会的报告程序, 高级管理人员, and operating leaders; including daily and monthly dashboards of identified KPIs as well as monthly performance and budget variance analyses.

- Managed the relationships with professional services providers, including banks, auditors, and legal.

- Led human resources, accounting, and corporate development teams.

- Built and maintained a financial model for internal projections and external fundraising efforts.

- Executed three roll-up acquisitions to develop a national service coverage footprint.

重点领域:预算,合并 & 收购(M&A), 球场上甲板, 筹款, 数据分析, 金融建模, 企业资源规划(ERP), 财务规划 & 分析(FP&A)

美艾萨克公司

- Developed the strategic case—initiated and managed the acquisition and integration of both public and private companies, 总计超过1美元.2 billion in value and growing the company approximately 400%.

- Executed the sale of several non-core business units aggregating over $100 million in value.

- Initiated and managed a $400 million convertible bond offering.

- Conducted investor roadshows, shared buyback programs and analyst relations programs.

- Initiated and managed a competitive intelligence function to monitor industry/competitor issues.

- Served as member of the board of directors of investee companies (Open Solutions Inc.)和有限合伙人代表(Azure Capital).

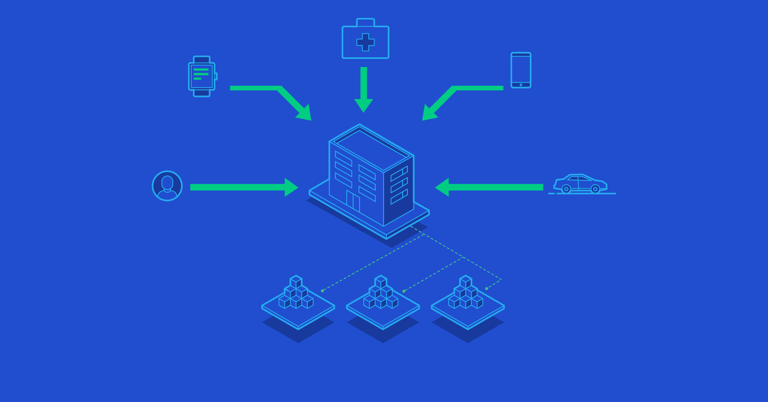

- 管理战略规划功能, including analyses of proposed entry into new market segments (i.e.(医疗保健、零售和保险等垂直行业).

重点领域:投资者关系, 球场上甲板, 估值, 金融服务, Fintech, 金融建模, 筹款, 战略规划

澳大利亚国民银行

- 管理M的所有元素&一个交易.

- 发达的银行增长战略.

- 执行银行风险投资项目.

- 管理米&新办公室的团队.

- Evaluated and executed bank's acquisitions in UK, NZ and US.

Focus areas: Investment Banking, Corporate Development, Consumer 金融, Strategy, 合并 & 收购(M&A)